FBMKLCI daily chart picture (A)

FBMKLCI trend breaking 20MA

From the daily chart showing FBMKLCI is on a strong support at 20MA since 2011 December until recently 15/5/2012 with a down-trend signal with a confirmation on the following date of 26/5/2012. What we understand is that we should sell off all our holding shares while the confirmation of KLCI is in down-trend.

FBMKLCI weekly chart picture (B)

We can clearly see from the above weekly chart that FBMKLCI is breaking below 20MA where the long black candlestick at the end of the chart is slipping downward passing the 20MA red line.

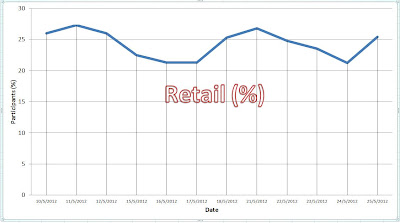

Foreign Fund and Retail Investors continuously selling will lead to a down-trend in KLCI. If you are following the chart that I post daily, you may see Foreign Fund's daily activities - selling, collecting profit and slow buying on these days. The concept of "If.. Then.. " is very useful in forecasting what will happen in our market. With this concept, you may easily detect what will be happening in upcoming trend. Do not feel surprise that if KLCI is in green then the chart showing that it is breaking below 20MA and bearish. Since most people are unfamiliar with Technical Analysis, they will not be able to detect this movement. And thus making unnecessary mistake in trading.

This is how I perceive the movement of KLCI with the guidance of my sifu

Mr Lee. Technical Analysis is one of the most important elements for us to consider if we intend to have a profitable trading.